Shiv has been recognized by Forbes Magazine as a CMO Next (2019), by Ad Age as a Media Maven, by Business Insider as a Payments Industry Game Changer, by Adweek as a Top 50 Marketer (no. 11) and by The Internationalist as a Top 100 Influential Leader. He has also authored several books including Social Media Marketing for Dummies and Savvy - Navigating Fake Companies, Fake Leaders and Fake News.

We sat down with him to talk about how the uncertain state of the economy is affecting consumer outlook and what steps LendingTree is taking to help their consumers during this difficult time.

Q: What is the vibe of your customers right now regarding the state of the economy?

The words I would use are tears and desperation. We're the largest financial services or financial products marketplace in the country. We've been around 26 years with 110 million customers over the course of our history -- billions and hundreds of billions in loans serviced through us. We have a lot of folks across America who come to us for not just home purchase loans, but they need a loan for their wedding or they're planning an extension to their home because they're having a first child or they've had an emergency and need to pay medical expenses or they're trying to make payroll for their business. And all of a sudden getting that loan, and having their personal finances in order has gotten so much harder. And it's sadly put a pause on a lot of things for them and in some cases dramatically even changed their lives. So I hate to sound very depressing, but it has a very real and quick impact - and we’re seeing it already.

Q: How is your approach shifting as you’re weighing a potential recession?

We're seeing the biggest shift in recognizing that we actually have to play more top-of-funnel, to use our marketing language. A lot of our business is driven through bottom-of-the-funnel acquisition; we are one of the largest digital spenders in the country.

But at a time like this and the point I emphasize with my internal team is that it's all about empathy and being that educational and trusted source even if there's no transaction to be had in the immediate term.

Because when we come out of this downturn - which we will, we always do, it's 12, 18, maybe 24 months - we will be remembered if we take good care of our consumers and if we are on their side, having their back and really looking at the world through their lens. Especially because if I have a major life event for which I need money and suddenly I can't get it, I'm in a massive panic. I actually need someone to care to share other alternatives with me. And sometimes the alternative may be as simple as, well, delay that purchase or delay that activity. Or it could be, you know, look at this other offering or this other product or have you thought about, I don't know.. using your garage as an extra room instead of building a new extension to your house.

So it doesn't necessarily translate into short term revenue, which can be extremely hard at a time like this where we have a business that we have to grow and develop. But it's the right thing to do. And having been through a few recessions, I know it pays dividends in the long run.

Q: How do you navigate making those recommendations to the C-suite or board?

Well, the approach I take is what choice do we have? If there are any other better ideas, I'm willing to take them and explore them and test them. Of course, we're doing all the usual tricks as well, which is shifting where we put emphasis in our portfolio. So obviously away from purchase loans to personal loans and to home equity type products.

But that's all the basic stuff. Beyond that, what I communicate is, what choice do we have? And let's also use this moment to reassess how we measure the efficacy of our marketing and customer experience effort, because everything that worked incredibly well for us when the economy was booming and everyone was refinancing, you know, those same measures don't help us understand what's going on or help us determine how to respond.

Q: What are some of the lessons learned from the last economic downturn that we could potentially use going forward?

I was at PepsiCo at the time and some of my key learnings were, hug your most loyal customers and really take care of them. Because you have to cut back on your spend sometimes and you want to do that in channels that attract the transactional customers that aren't coming back. So hug your most loyal ones, whether it's through your own channels or through more highly engaged channels to attract them.

The second one was to - don't mind the violent metaphor - but kill all the sacred cows. Because the sacred cows stop being sacred in a downturn, and you really discover that they aren't that sacred after all. So might as well just focus on innovating out of the moment of the recession.

And then the third one, which I felt at that time and I was reminded of just a few weeks ago… there's really strong talent [out there] that has more time on their hands [due to layoffs and restructuring]. Bring them over to work on [your] business. Let's get the best people we absolutely can so that we are then ready for the economy when it bounces back. That was another takeaway for me.

Q: Is there any GenZ-specific strategy you are implementing

With [both] our employees and with our customers - for many of them, this is their first recession, so they're like a deer in the headlights and even more worried and panicked - and understandably so.

A few things that we're doing, one is we're really emphasizing advice and being consultative… more than we ever have in the past.

The second thing that we're doing is - we do a lot of press. In the last 24 hours, our analysts were in USA Today, Time magazine, on CNBC, and a whole bunch of places talking about the [Fed interest] rate increase. I've asked the analysts to talk directly to our Gen Z audience. So when we're talking to the press or we're being covered or featured, to address the Gen Z audience more personally and more directly because helping them understand and being there for them is a huge thing.

And then the third is and someone touched upon it already, being much more empathy-driven and long-term oriented. And as a part of that, we're actually updating all of our CLV formulas because we're finding we have to look at them a little differently during this time period.

Q: What’s one brief life-hack we can all use to weather this time?

I have a work one and a personal one. The work one is: comparison shop. Granted, that's our business, but you can literally save tens and thousands of dollars when you comparison-shop, especially for financial services products.

And then on a personal level, attend more PTTOW! events. I mean, that's a good way to get through the downturn in my view!

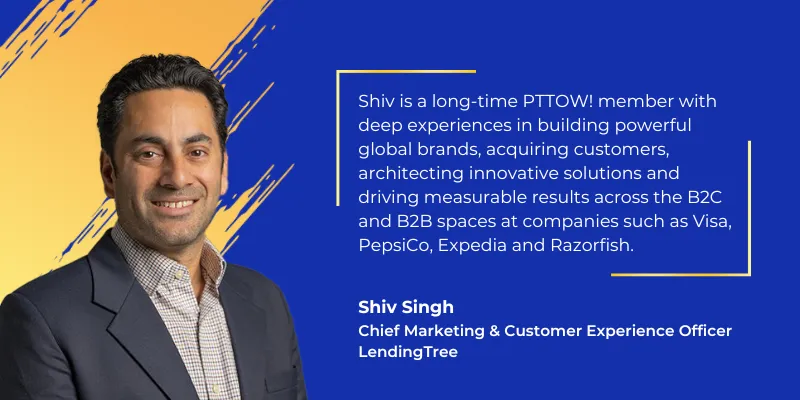

Shiv is a long-time PTTOW! member with deep experiences in building powerful global brands, acquiring customers, architecting innovative solutions and driving measurable results across the B2C and B2B spaces at companies such as Visa, PepsiCo, Expedia and Razorfish.

He has been recognized by Forbes Magazine as a CMO Next (2019), by Ad Age as a Media Maven, by Business Insider as a Payments Industry Game Changer, by Adweek as a Top 50 Marketer (no. 11) and by The Internationalist as a Top 100 Influential Leader. He has also authored several books including Social Media Marketing for Dummies and Savvy - Navigating Fake Companies, Fake Leaders and Fake News.